One of the key ways to motivate your clients to agree to engage your tax planning services, is to show them how much tax their family group is likely to pay for the financial year

Here's how to export a quick and personalised client offer which outlines the Value, Plan and Price of your tax planning service and highlights how your advice can benefit your client.

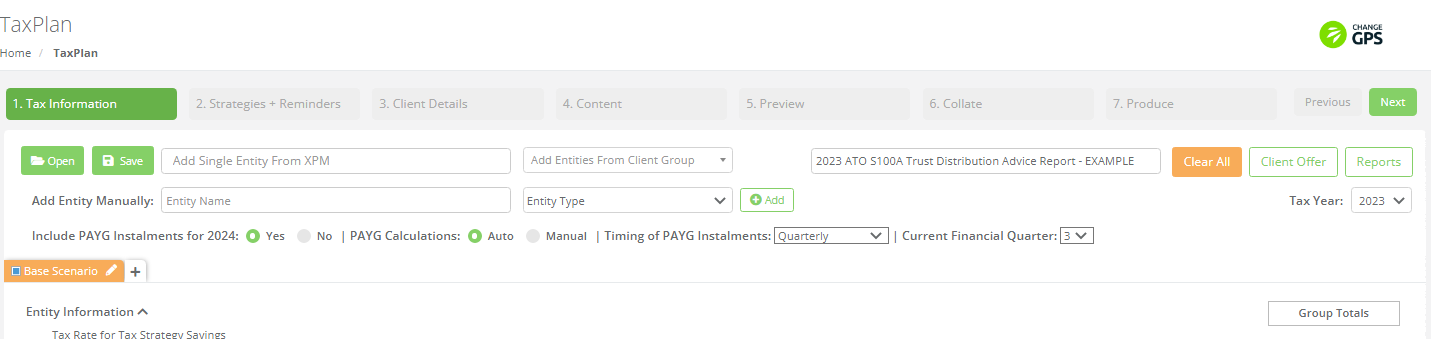

The "Client Offer" is a new feature available directly in TaxPlan (Pro and Advanced Tiers) which enables you to effortlessly create a detailed forecast of your client's expected 2023 income and tax payable. Here's how to generate it now:

Step 1: Create a new TaxPlan file for your client with just a Base Scenario

- Add the client group or entities and create a basic Base Scenario with the ESTIMATED wages and/or profits and usual allocations to entities.

- Don't add any tax planning strategies to this scenario.

- TaxPlan then auto calculates the tax your client will pay without any tax planning adjustments.

- Save your changes.

Step 2: Select Client Offer in the top navigation and download the Word Document

- The downloaded template will automatically include an estimated income and tax payable summary table for each entity and the family group total.

- Populate and customise the text areas in red to personalise the content to suit your client.

- Include the sections that are relevant to your client group and remove those that aren't required.

- Estimate the work involved and the amount if the client doesn't have a fixed price agreement.

- Save your changes.

Step 3: Send the final document as an email or letter

- The Client Offer export makes it simple to explain and educate your clients and clearly demonstrates the value of your tax planning advice.

Step 4: Client Accepts or Declines

- On acceptance, send your client an Engagement letter or if client declines send the "Confirmation of Rejection of Offer of Tax Planning" email.