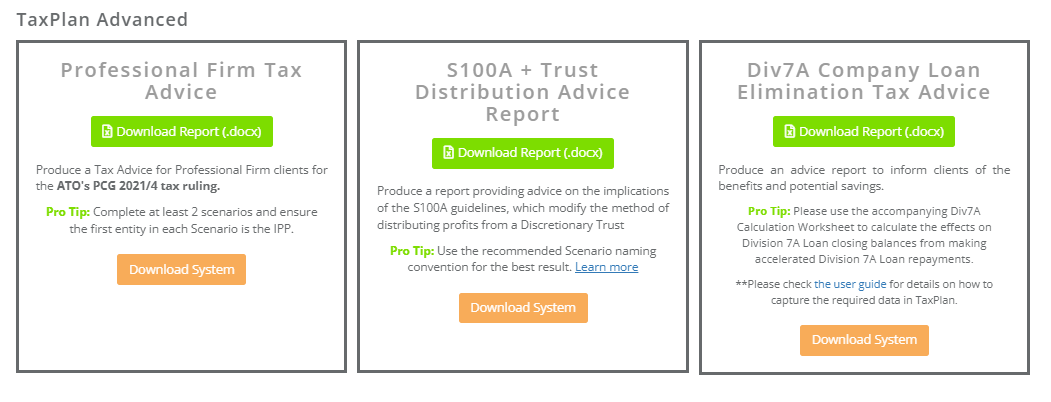

With the TaxPlan Advanced tools you can firstly calculate the interest saved with accelerated dividend payments (or other cash reserves) to reduce a Div7A loan, and then send your client a professional advice report

Step by Step Guidelines

Prepare Interest Saved Calculations

Download the Div7A Workpaper to model how the Div7A interest rate increase will impact your client.

The purpose of our Div7A Loan Elimination Worksheet and Advice Report is to assist clients to understand their options should they choose to pay back their Div7A Loans at an accelerated rate. It’s not designed to be a comprehensive Div7A Loan Calculator.

The vast majority of accountants use either 1 July or 30 June to declare a dividend to use the funds to repay a Div7A Loan which is what is now available in the new version of the Worksheet.

Note: Some clients have Trusts that pay company tax instalments during the year and classify these as repayments of the Div7A Loan - in these scenarios we recommend using the ATO Div7A Calculator.

Inform & Educate

To initiate conversations with your clients, use the Value Plan Price client email template to offer this advice report.

Prepare the Client Advice Report in TaxPlan

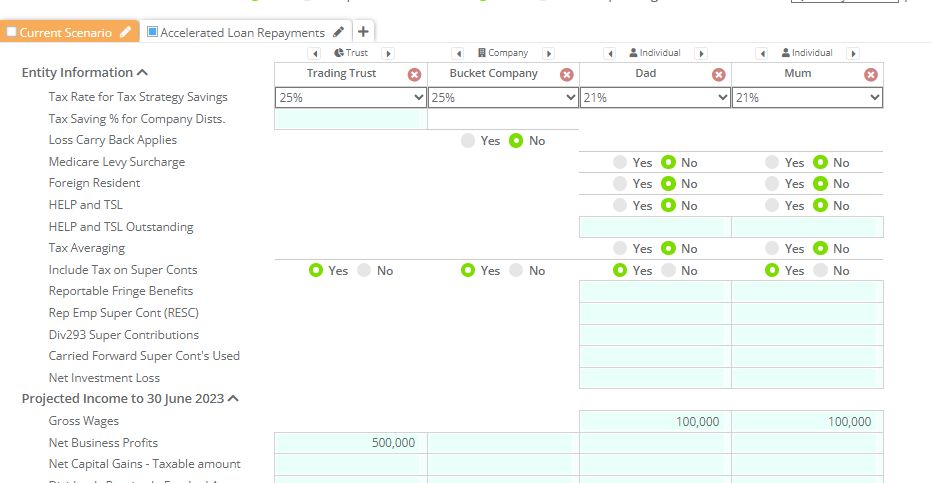

- Create a new TaxPlan and add the company and individual client.

- Watch the above video to learn about how to enter the income data for this specific advice report. It does differ from the usual tax planning requirements.

- Step 1. Create a Base Scenario

- Add the Income and Div7A Interest Received amounts for the company

- Add the usual income for the individual with no additional Dividend distributions

- Step 2. Copy the Base to create a new Minimum Annual Div7A Repayment Scenario

- Add the Distributions for the minimum payment amount to the individual as a repayment

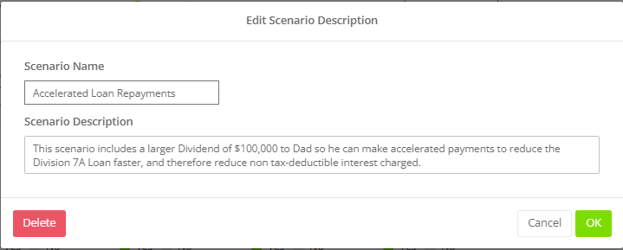

- For this scenario add the following example description (click the Pencil icon to edit):

This scenario includes your annual minimum repayments for a Division 7A Loan with a starting balance of $XX,XXX from the Bucket Company to [add name] .

- Step 3. Create a new scenario for Larger / Accelerated Div7A Loan Repayment

- Add the lower interest payable amount on this scenario.

- Add the larger Distribution amount to the individual

- Select this as your recommended scenario

- Add the following description:

This scenario includes a larger Dividend of $XX,XXX to [add name] allowing for accelerated payments to reduce the Division 7A Loan faster, and therefore reduce non tax-deductible interest charged.

- Download the advice report from the Reports modal (available to TaxPlan Advanced subscribers)

- The Scenario summaries will be automatically included.

- Further personalise the advice report as indicated in red text.

- Select which Strategies to Consider to Eliminate your Division 7 Loans to include for your client

- Calculate the tax savings from making accelerated loan payments and complete the Benefits from Accelerated Div7A Repayment table provision for in the report.

Tax Savings are for the first year are calculated for you as the difference between the Base Scenario and the Recommended Scenario.

- Save the advice report to you Document Management System and send to your your client.

Follow up with client with following:

- Prepare a Dividend Statement

- Plan for larger annual minimum repayments

- Pay off loan from other funds