Why accountants need to offer Fringe Benefit Tax (FBT) returns preparation to help clients reduce their ATO audit risk and lodge their FBT returns.

Key points:

- the ATO can go back an unlimited number of years to audit businesses for FBT

- lodging an FBT return, even if there’s nil FBT, limits the ATO to a 3-year audit period

- our job as accountants is to make clients aware of our services and give them the choice to engage us

- if a client declines FBT return preparation, ChangeGPS provides follow up systems that put the responsibility back onto the clients and de-risks your firm

- ChangeGPS provides resources that constantly improve learning, service development and client engagement, so use this as the reason to explain why FBT is important now:

“Our opinion right now is based on what the ATO is doing, so here’s why we need to lodge an FBT return this year…”

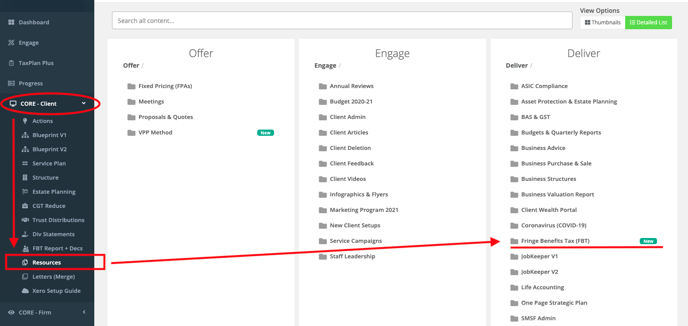

FBT Resources

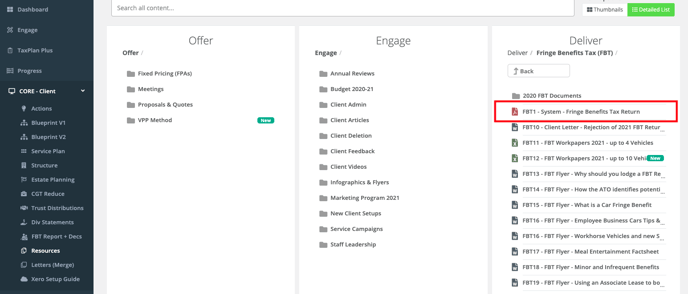

FBT Return System Documents

See FBT1 – System – Fringe Benefits Tax Return:

The ChangeGPS FBT Client Service System provides:

- An overview of what FBT is (with example), paying FBT and business owner obligations

- Rationale as to why clients need this service including a reminder about the legislation — FBT is work that you need to do now so clients understand what is going on, the value of any fringe benefits and how to fix things before the year-end

- How to offer this service to clients including VPP methodology and template emails positioning the FBT service being offered before FYE (not at FYE) and rejection confirmation

- Price guidelines tiered by employee benefits

- Invoice description itemising the components of your service, including auto-journal entries

- Team member involvement outlining responsibilities for profitable service roll-out

- 7-step process showing actions and responsibilities

Business Client Email — Fringe Benefits Tax

In its entirety, this document explains the client action required in respect of FBT. Each client communication should be sent out individually by each one of your accountants.

Fringe Benefits Tax (FBT) Questionnaire

Making clients aware of FBT so they act

Putting the responsibility back onto your clients and de-risking your firm:

- The FBT Questionnaire can be fully customised to your firm’s branding

- The Authorisation needs to be signed by clients as proof that they fully understand the questions

- Forms (such as Odometer Readings) are also included

- It’s important that you have every client complete and return the FBT Questionnaire to you

Rejection of FBT Return Offer

If a client does not want an FBT Return lodged, email this confirmation or post as a letter to them and this de-risks your business. It forms an important part of the process by making your client take responsibility.

VPP: FBT Return

- Use this email to strongly recommend that your firm prepares and lodges a client’s FBT Return – great to send to any clients who might be ambivalent about FBT

- Wording does repeat earlier themes, but VPP method outlines value proposition specifically

- The Next Steps section of the VPP email is an important reminder to clients that the ball is now in their court

- Fully customisable 8x educational marketing flyers including How the ATO identifies potential FBT employers and Why should you lodge and FBT Return?

FBT Workpapers

FBT Return Review Checklist (Excel Spreadsheet)

- Easier navigation and user experience for accountants

- Enter data into the grey cells only

- Select / deselect FBT Workpapers on the Index cover page worksheet

- All FBT items are ordered in a checklist

- Worksheets can be full customised however columns calculate back to the summary cover sheet – we have allowed for up to 10 cars to be added

2022 FBT Launch Webinar

Need help?

Contact your ChangeGPS Member Success Manager for specific advice at https://changetech.cloud/support.