- ChangeGPS Knowledge Base and Support Articles

- TaxPlan

- Getting started with your first TaxPlan

How are the marginal tax rates used in TaxPlan?

Marginal tax rates need to be selected as the Tax Rate for Tax Savings calculations

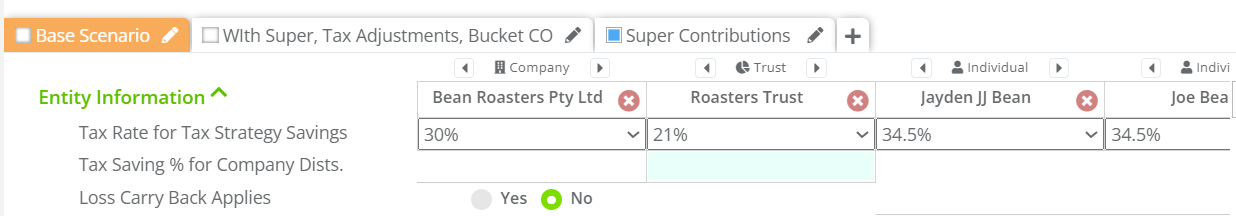

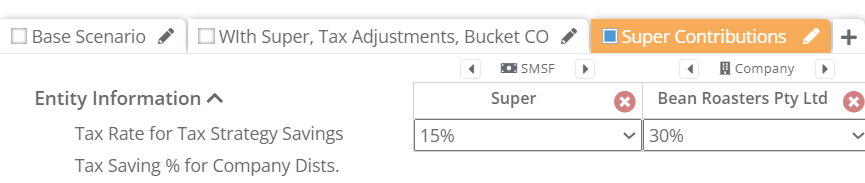

After adding the client group, select the marginal tax rate in the first instance for each individual and entity.

This tax rate is used used to calculate the tax savings on the Recommended Scenario.

For example; Bean Roasters marginal company tax rate is 30%

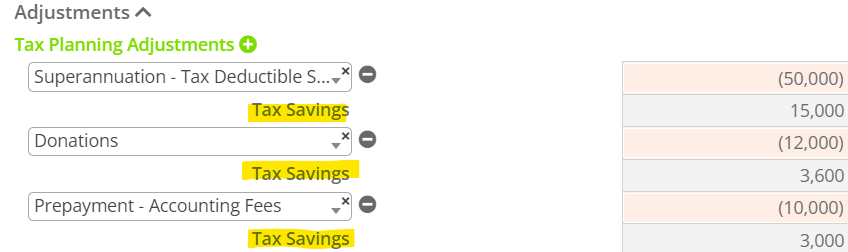

This rate is used used to determine the tax savings for any Tax Planning Adjustments added for Bean Roasters.