- ChangeGPS Knowledge Base and Support Articles

- TaxPlan

- TaxPlan Advanced

Where a PSI Company incurs a loss. How do I show that loss to the individual in TaxPlan?

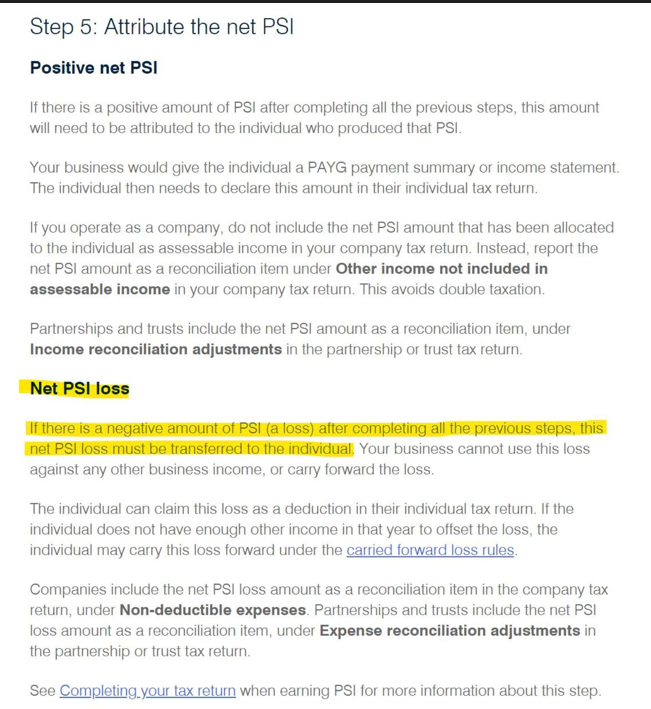

See ATO article - it's a Reconciliation Item on the Tax Return under "Non-Deductible Expenses"

How to capture this in the TaxPlan scenarios

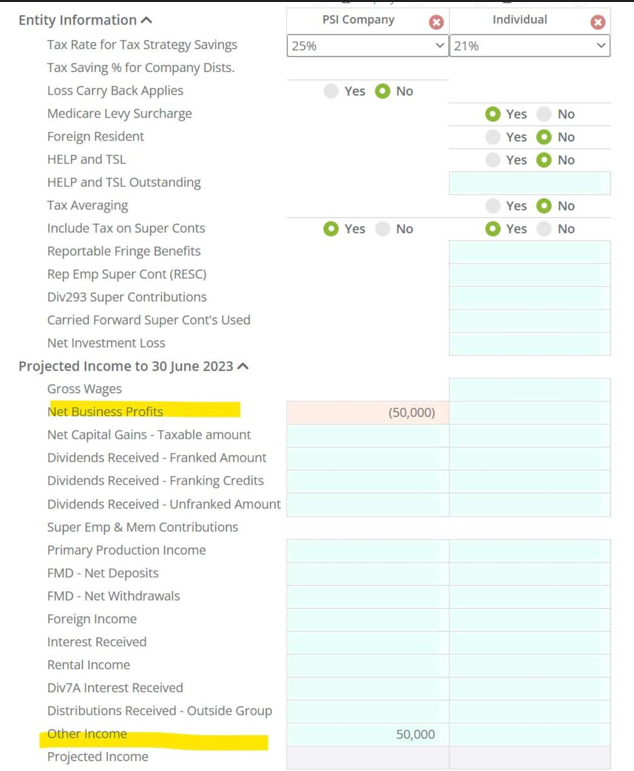

Assuming the PSI company made a $50K PSI loss for example - enter this as negative $50K in "Net Business Profits" for the Company entity.

This now needs to be added back by the company.

Enter this in the PSI Company under "Other Income" to bring the Taxable Income back to NIL in the PSI Company.

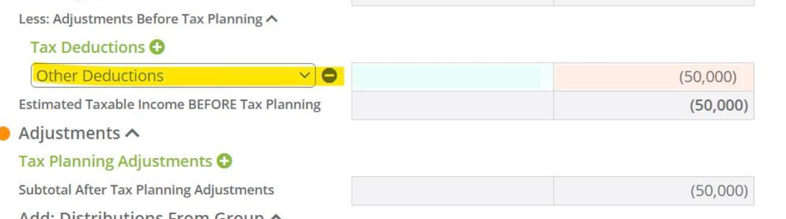

For the Individual: Enter the PSI Loss attributable from the PSI Company to the Individual under "Other Deductions".

Alternatively, it could be entered in the Individual as a negative "Other Income". This puts the $50K loss in the name of the individual.