This article provides an overview of the report builder tabs and data entry needed to create a TaxPlan report

See Introduction to TaxPlan for detailed instruction on the first steps of the report builder

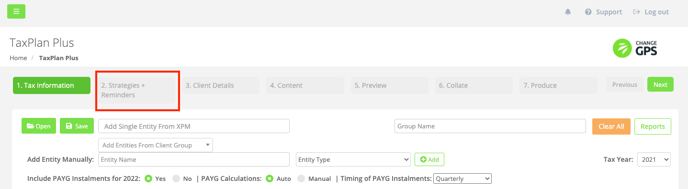

Strategies & Reminders

Please note: the first nav tab preceding this is called Tax Info

After entering the tax information, tax planning strategies and a number of scenarios, you’re ready to compile your TaxPlan report:

- Click Save to overwrite all the work you’ve done so far

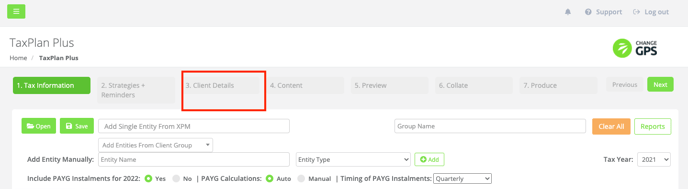

Client Details

- Click Next (top right) to progress to the Client Details tab

- From the Client Search section use the Client Search box to select the main client that you want the report to go to by choosing from the dropdown, or

- Go right to the Contact Search > Choose a Client box to search from XPM, or

- Enter the client’s contact details manually by populating the fields: Name, Email, Addressee, Salutation, Physical Address and/or Postal Address

- All your entries will Preview in the panel on the right of the screen

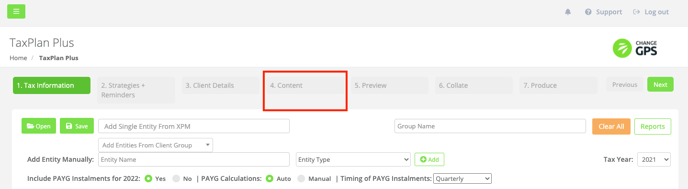

Content

- Click Next to progress to the Content nav tab to create your cover letter

- Change any content as required and always Save

- At the bottom of this section you have the option to select / deselect Exclude Scenarios, Exclude Calculations and/or Exclude Page Numbers

- Choose the report sender by going to Send as: and selecting a name from the dropdown

- Go right to Select Client Management Team and Add Team Member photos to your report

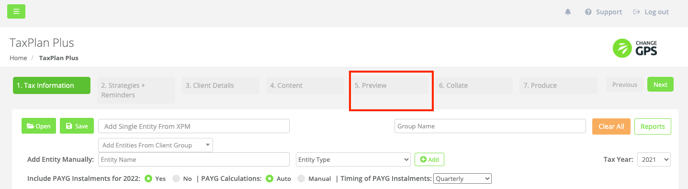

Preview

- Click Next to progress to the Preview nav tab (normally takes 5-10 seconds for this document to compile)

- The report is generated showing your letterhead, watermark logo and your signature block (as originally set up in TaxPlan)

- On the left of the screen click the green WORD (.DOCX) button to download the document into MS Word or progress to the Collate tab to download it as a PDF document

Document features

- Professionally designed title page

- Introduction explaining tax planning basics as well as a brief summary of recommendations for the client and call to action

- Tax estimates report showing the taxable income before and after tax planning, tax assessed for the year and the balance of any tax payable (or refundable) with your value proposition illustrated graphically

- Itemised recommendations for each entity showing strategy, spend amount and estimated tax savings (or payable) and year-end reminders

- Alternative scenarios comprised of base scenarios and recommended tax planning strategies so that the benefit of your advice is made very clear

- Tax calculations showing the calculations for each entity (almost like a mini tax assessment notice so you and your clients can look at what is estimated to happen for the year)

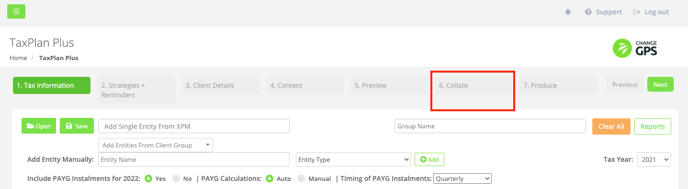

Collate

- Click Next to progress to the Collate nav tab to review the entire document in a PDF compiler

- Here you can add in any extra documents required, for example if you've done some financial statements on an Excel spreadsheet with projections, you can add that

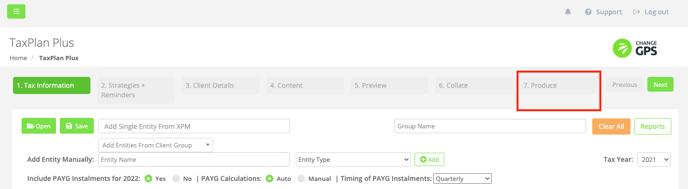

Produce

- Click Next to progress to the Produce nav tab

- Save the document as a PDF and send it as a PDF attachment via email or save it into your document management system using the options at the bottom of the screen

- You can always go back at any stage, re-review your report, download as a Word document, change content and then Save as a PDF to send to a client

Watch the full instructional video below:

Click here for additional TaxPlan training videos