In order to improve the Div 293 calculations in the TaxPlan estimates we made the following changes to allow users to enter both the RESC and Total Super Contributions required for Div 293 calculations

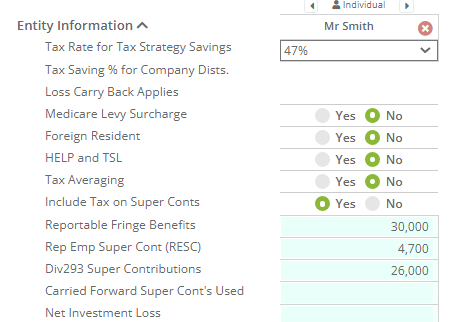

In the Entity Information section for Individual entity types, we previously only had "Reportable Super Contributions" which was specifically used to enter the Total Super Contributions

Before

After

Now you will find a new data entry field for Reportable Employer Super Contributions (RESC) and a separate Div293 Super Contributions field which will be used in the Div 293 calculations instead.

Please note: When loading previously saved TaxPlans, users will now find the amounts entered in the earlier "Reportable Super Contributions" field has moved to the RESC field. Users may need to adjust the amounts in order to correct any Div 293 calculations.

Reportable Employer Super Contributions are not included in assessable income. However, they are used along with taxable income to work out if your client meets the income tests for benefits, concessions and obligations the ATO administers, such as the:

- Medicare levy surcharge threshold calculation

- Medicare levy surcharge (lump sum payment in arrears) tax offset

- Low income super contribution (income threshold)

- Super co-contributions

- Deductions for personal super contributions