Easily produce a client report providing advice on the implications of the S100A guidelines, which modify the recommended method of distributing profits from a Discretionary (Family) Trust

Key Features of this client advice report:

- Discusses the impact of the ATO's new Tax Ruling (TR 2022/4) on the allocation of profits from Discretionary Trusts.

- Outlines the potential risks associated with making trust distributions to adult children or arranging for them to give the distribution back to parents or grandparents.

- Provides advice on how to navigate the ATO's views and stay in the "green zone" to avoid an audit.

See it in Action

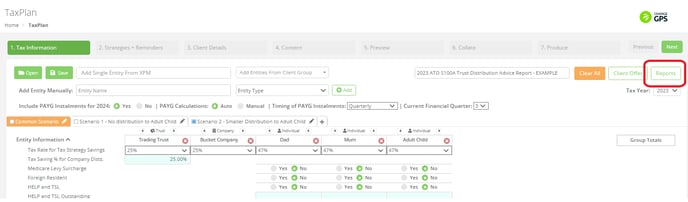

Required naming conventions to create the ideal scenario comparisons as follows:

Please note the recommended naming conventions to produce the optimal client report

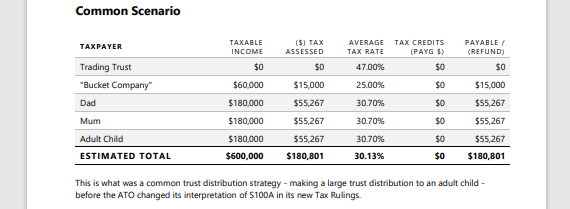

1. Base Scenario

Starting with the Base Scenario (change the name to Common Scenario) and include the usual trust distribution strategy of making large trust distributions to an adult child. For example:

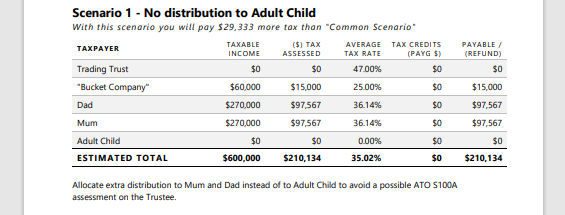

2. Scenario 1

On the next scenario (change the name to Scenario 1 - No Distribution to Adult Child), allocate extra distribution to Mum and Dad entities instead of the adult child. For example:

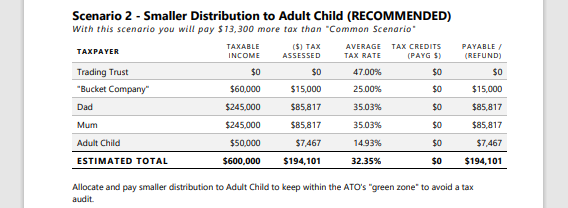

3. Scenario 2

On this scenario (rename this to Scenario 2 - Smaller Distribution to Adult Child) and allocate and pay smaller distribuiton to adult child to keep within the "green zone" and avoid a tax audit. Select this as the Recommended scenario. For example:

Next, export the advice report

Click the Reports button to download the pre-formatted report

On the Reports Modal select the following. This will download a MS Word document. Be sure to save this to your preferred local drive.