Use this report to confirm with your clients when their tax is payable over 18 months and/or itemise the ATO Tax debt repayment plan

Tax planning involves 2 key things:

1. Strategies to reduce your client’s tax; and

2. Informing your clients of when their tax is payable over the next 18 months.

With a “TaxFlow” report which outlines all your PAYG and tax debt repayment amounts over 18 months, your clients can properly plan for all their tax payments.

Impress your clients with this value added service with little extra effort

How? Generate a Tax Flow Report with TaxPlan

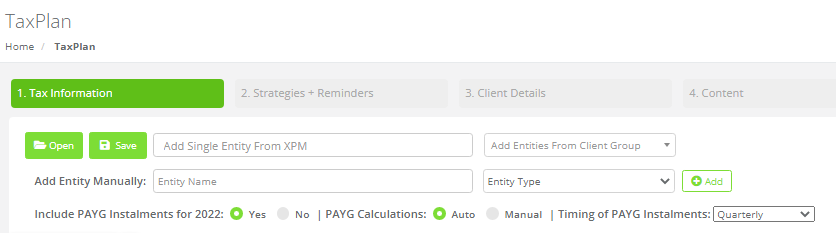

Firstly, add your client data:

Once you've created a client file in TaxPlan, at the top of the TaxPlan info tab you will find the option to include PAYG Instalments for FY: - select Yes. Select PAYG Calculations: Auto or Manual and select the scenario that you want to use with the TaxFlow report.

Secondly, add the required TaxFlow financial data:

Scroll down to the TaxFlow Information data entry section:

- select the Month that any tax payment or refund is due

- update if there are final amounts of PAYG Instalments

- list the ATO Tax Repayment Plan details if applicable

- populating the report with this data will auto-generate FY Estimated PAYG Instalments.

The header ATO Tax Repayment Plan typically relates to BAS, activity statement debt or tax debt so include or exclude whatever is appropriate to help your client understand their tax position.

Next Steps

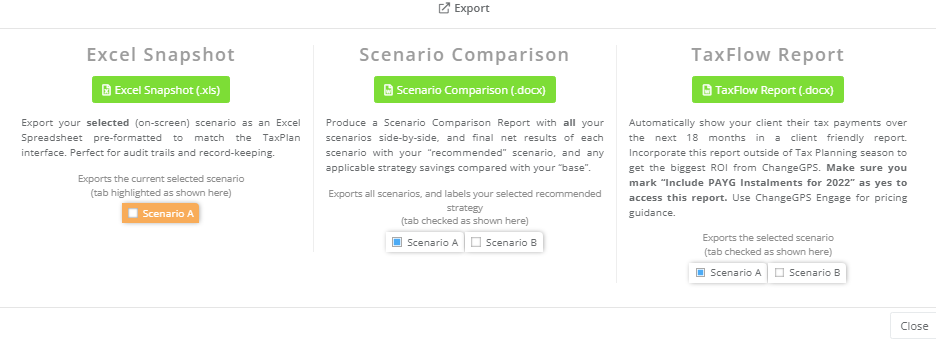

Go to Reports at the top right and select on TaxFlow Report. A Word document is generated which opens your TaxFlow Report with your firm’s logo and details on the cover page.

FY Tax + PAYG Instalment Forecasts

The report outlines information about forecasts and how PAYG instalments will be used as prepayments for your client’s next year's tax return:

- scroll to FY Estimated Tax Position for the estimated, itemised tax position for FY populated straight from your TaxPlan

- go to heading FY Forecast Tax Payments for forecasts which start in January FY and separates the trading company showing any tax payable or refund for FY; FY tax PAYG instalments; FY PAYG instalments and any amounts payable on an ATO tax repayment plan.

At the end of the report we state that these are estimates only and the final amounts may change. (NB: Right now there is no GDP uplift published by the government for FY PAYG instalments, so there's no inflation amount. If one is released we will update TaxFlow to give those increased amounts for FY PAYG instalments.)

That’s TaxFlow by ChangeGPS. It makes it so much easier for your clients to understand their tax payments for the next 18 months and is such a valuable report to send out to all of your clients.

Accounting! with Dave and Tim Webinar

How to Manage your Clients’ ATO Debt | 22 November 2021

KEY TAKEAWAYS:

The ATO will recommence their firmer and stronger engagement activities with your clients with outstanding obligations.

Your clients will need your help to set up repayment plans.

This is work you should be charging for and the VPP method can help you do that.