Summary of all the changes and enhancements available to all TaxPlan users (Pro and Advanced tiers) from 29 Feb 2024

🌐 Join the D&T Webinar: "Unlock the true potential of Tax Planning"

and

🖱️Follow this walkthrough guide to get familiar with the specific changes.

Also, look out for the in-app beacons indicating an updated feature.

1. Tax Planning Strategies and YE reminders now rolled over for 2024Summary of all Tax Adjustment Strategies available to download and share with your team from the Core Resources > Tax Planning folder |

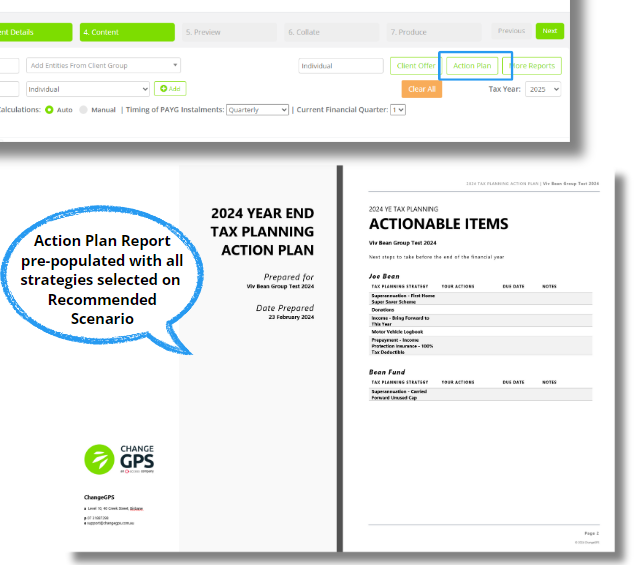

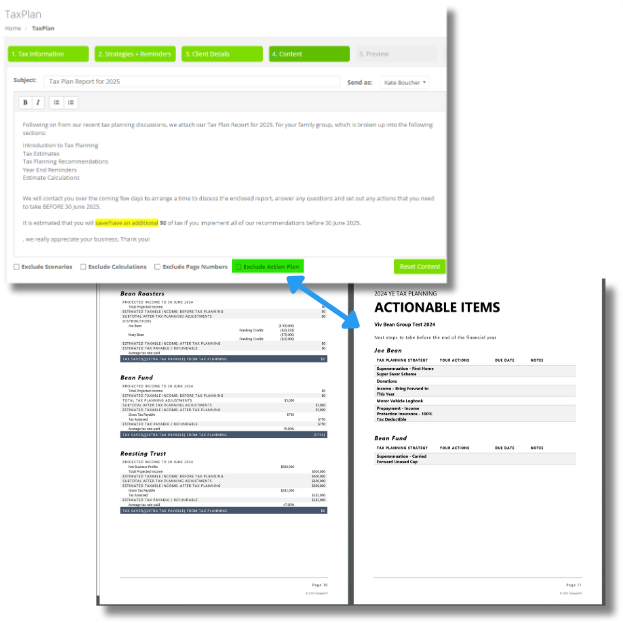

2. New downloadable Action Plan Report for recommended strategiesThis new report itemises the actions to take pre-30 June to get the right tax outcomes. Available as a stand-alone report or optionally included in the client advice report. A new downloadable stand-alone Action Plan report can be generated for the srategies included in the recommended TaxPlan scenario. This will help clients clearly understand what needs to be done pre-30 June to get the right tax outcomes. Download and edit report in Word to finalise.

Also appended to the full client advice report

|

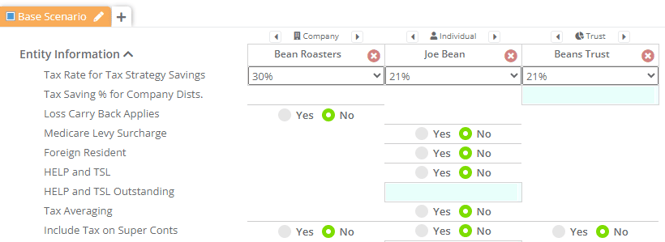

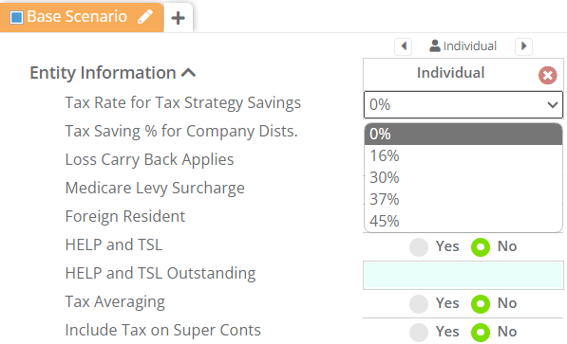

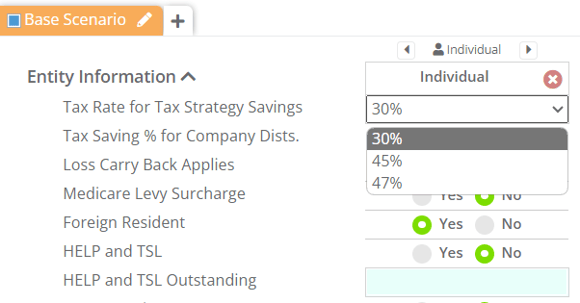

3. Changes to default settings in the Entity Information sectionFor the options in Entity Information, the default is now set to No. Previously mixed yes and no values were set when starting a new advice report.

|

4. Now do the accounting to tax rec directly in TaxPlan 🎉We made some changes to accommodate the need to use accounting income and deductions to complete a tax reconciliation directly in Taxplan. New Accounting Profit Year to Date income data entry with the full year projection auto-calculation In the Projected Income section. users can now optionally add a YTD Accounting Profits amount, select the As At month and the projected income amounts will be extrapolated for the whole year. Alternatively users can continue to manually add the Full Year Net Profit Estimates.

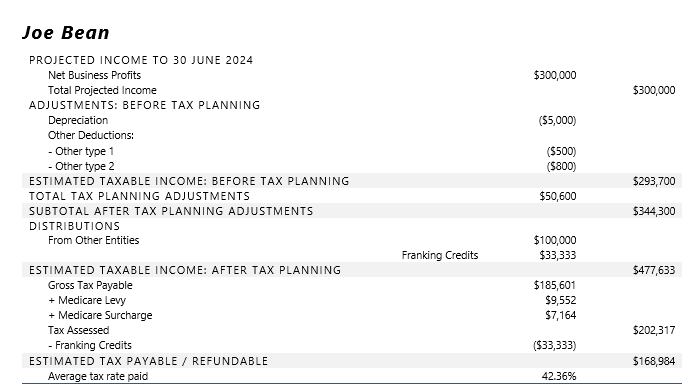

Add multiple Other DeductionsIn the "Less Adjustments Before Tax Planning" multiple Other Deduction rows can now be added and also a new Depreciation type available. Previously other deductions were limited to single data input meaning these calculations had to be done offline instead. |

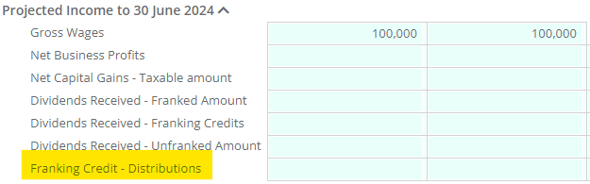

5. New income input row to capture separate Franking Credits from DistributionsIn the Projected Income section a new input row available has been added to itemise Franking Credits from Distributions separately to include franking credits received from franked distributions.  |

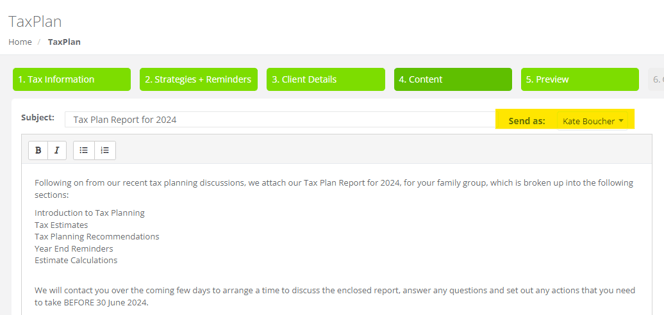

6. The Send As user default has changedTo accommodate multi partner firms it is now easier create TaxPlan reports to be sent from different partners. In the TaxPlan Report Builder tab > Content step the system will now remember the last selected Send As user on the Content tab instead of defaulting to the logged user's name every time and needing to change this manually.

|

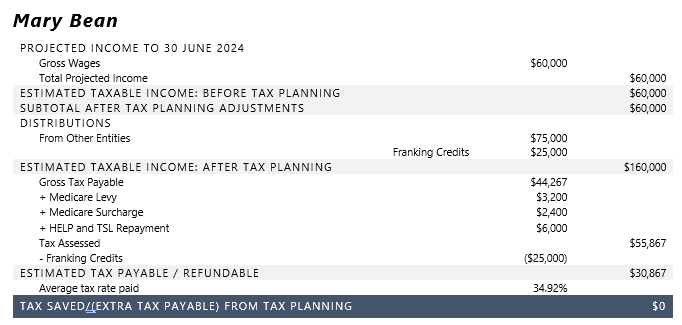

7. Update to TaxPlan Advice Report content:In the tax calculation summary pages of the advice report we tweaked the "Less" Adjustments: After Tax Planning row label to accommodate different scenarios. With Deductions

No Deductions

|

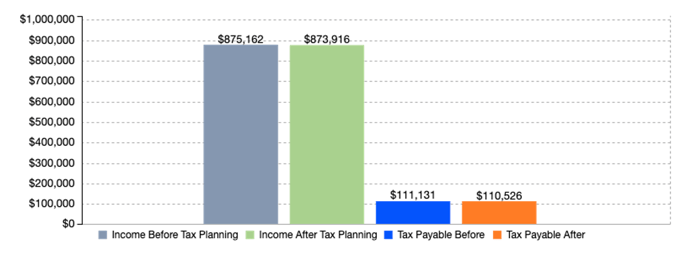

8. Update to TaxPlan Advice Report comparison graph:Amendments to the comparison graph in the report to show both tax payable/refundable amounts in addition to the taxable income before and after tax planning. Tax payable before tax planning is calculated by adding the tax savings to the tax payable after amount. For example:

|

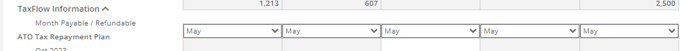

9. New TaxFlow Information section minimised and payable date defaults to MayTo simplify the TaxPlan data entry view, we have minimised the TaxFlow data entry for the ATO Tax Repayment plan. The default Tax Payable/Refundable month for the PAYG schedule created in TaxFlow report is also set to May.

|

10. To keep track of tax planning scenarios decisions and improve workflows, users can now add internal notes for each scenarioA new free text internal notes section is available for each Scenario tab. Users can add notes relating to the recommendations for Accountants to check as part of a review workflow. Notes can also be added in order to specify last year tax planning decisions.

|

11. Compare and discuss the 2024/5 stage 3 tax cuts with clientsTo faciliate client enquiries about the impact of stage 3 tax cuts, we have added the new 2024/5 FY individual tax rates. Create a current (2024) and next year (2025) TaxPlan report to show the client the difference in tax outcomes. New 2025 Stage 3 tax rates for Individuals

New 2025 tax rates for Foreign Residents

|