Trust distributions are included in the tax estimates summary for TaxPlan and seem to suggest that the distribution of trust income is a 'tax planning strategy'

Background:

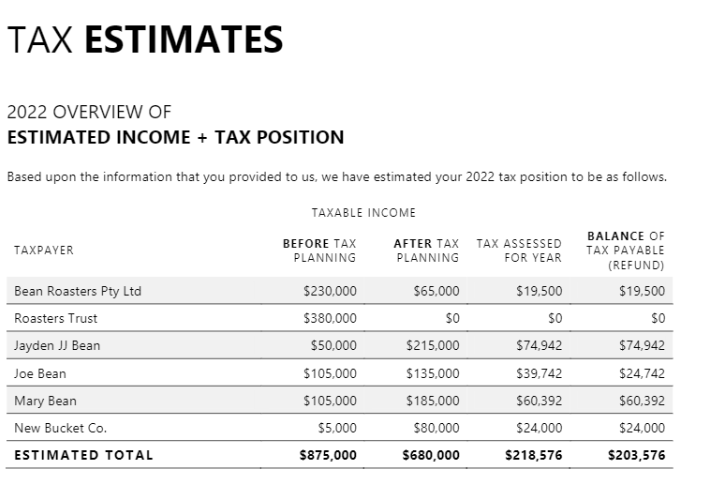

When there is a trust included in your client group, the 'Before Tax Planning' summary shows all of the income to the trust and none to the beneficiaries. Then the 'After Tax Planning' summary shows no income for the trust and the beneficiaries are allocated their correct share of income.

Reasoning:

We made the decision to show a trust as having all income in “Before Tax Planning” after receiving much feedback from many different accountants 2 years ago.

We believe that the allocation of trust income definitely is a tax planning exercise and should be explained to clients in this manner.

Amounts to certain beneficiaries may change after certain tax planning strategies are recommended (eg. Prepayments, Super Contributions, etc) and there needs to be a starting point to use for a client’s group.

We understand that there are a number of different ways to display the effects of tax planning, and we have always tried to use the approach that the majority of our users agree with.