Estimated PAYG can be auto-calculated OR be manually entered

For your TaxFlow reports available with TaxPlan Pro - the PAYG instalment projections are able to be included as an auto calculation OR you can select to manually add the amounts payable.

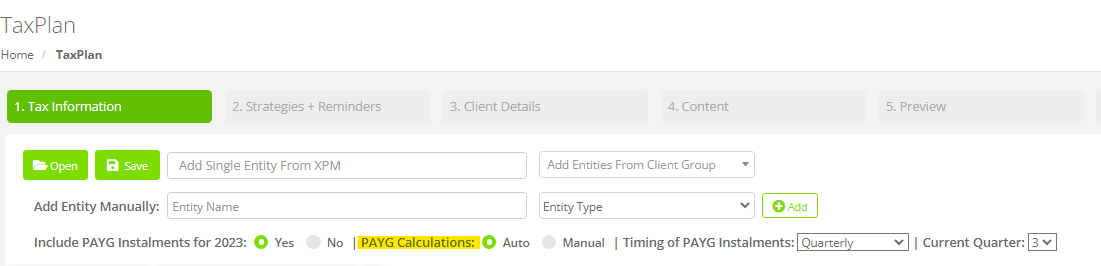

On the Tax Information tab of TaxPlan report wizard you can select:

1. To include or exclude PAYG instalments

2. Auto PAYG calculations or Manual entry

3. Timing of PAYG Instalments

4. Current financial quarter

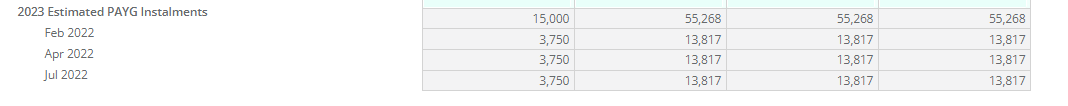

Example of an auto-calculation for quarterly payments:

In instances where the auto-Calculated amounts need to be more flexible or be customised based on your client's circumstances, you can instead select Manual in the settings above to add the required specific instalments for the months they are due.

See it in action:

Another frequently asked question

Why are there only 3 quarters available for the Estimated PAYG payments used in TaxFlow Report?

The assumptions is that the TaxPlan report is being prepared during the first quarter of the financial year for instance and that the return will not be lodged in time for the first quarter instalment. The only time you are ever going to have all four quarter instalments is if you prepare, finalise and lodge the tax return prior to the end of August when the first quarterly instalment is for and when its due.