How to produce a TaxFlow report in TaxPlan showing the next 18 months of a client’s tax payments for all of their entities and individuals within their client group.

Generate a TaxFlow Report

Once you've created a TaxPlan and added the strategies that you want to recommend to your client, create the TaxFlow report by selecting Include PAYG Instalments for FY: Yes at the top and, usually, PAYG Calculations: Auto and select the scenario that you want to use with the TaxFlow report. Then, underneath this section:

- select the Month that any tax payment or refund is due

- if there are final amounts of PAYG Instalments add those to flow through to the TaxFlow report

- list any ATO Tax Repayment Plan

- populating the report with this data will auto-generate FY Estimated PAYG Instalments.

The header ATO Tax Repayment Plan typically relates to BAS, activity statement debt or tax debt so include or exclude whatever is appropriate to help your client understand their tax position.

Next Steps

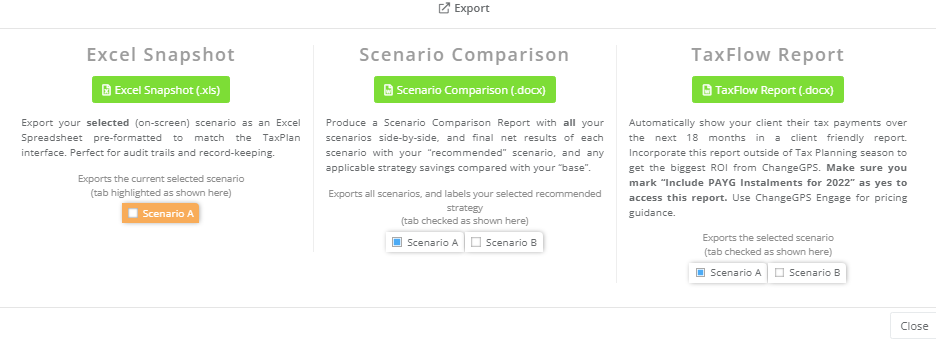

Go to Reports at the top right and select on TaxFlow Report. A Word document is generated which opens your TaxFlow Report with your firm’s logo and details on the cover page.

FY Tax + PAYG Instalment - Forecasts

The report outlines information about forecasts and how PAYG instalments will be used as prepayments for your client’s next year's tax return:

- scroll to FY Estimated Tax Position for the estimated, itemised tax position for FY populated directly from your TaxPlan

- go to heading FY Forecast Tax Payments for forecasts which start in January FY and separates the trading company showing any tax payable or refund for FY; FY tax PAYG instalments; FY PAYG instalments and any amounts payable on an ATO tax repayment plan.

At the end of the report we state that these are estimates only and the final amounts may change. (Please note: there is a 6% GDP uplift added for FY PAYG instalments - learn more)

Watch our full instructional video