- ChangeGPS Knowledge Base and Support Articles

- TaxPlan

- Pro Tips for TaxPlan

Estimated PAYG Intallments now automatically includes a 6% GDP uplift factor

For TaxFlow Reports prepared for next FY

When Auto PAYG Calculations are included for 2023, the Estimated PAYG Instalments are calculated on Estimated Taxable Income + 6%.

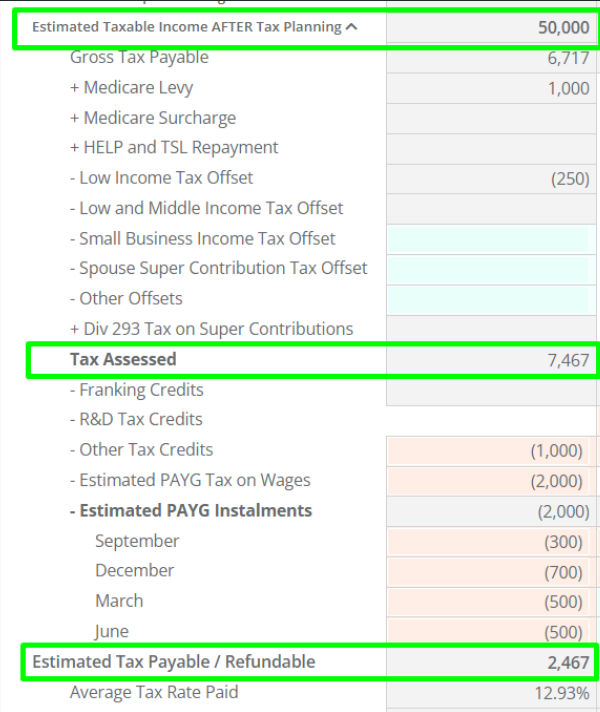

For example the Estimated Tax Payable may be calculated as normal below

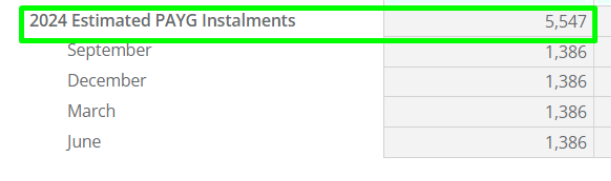

The 2024 Estimated PAYG Instalments in the TaxFlow Information section are calcaulted as follows:

With the 6% GDP increase, the uplifted Estimated Taxable Income would be $53,000.

Tax Assessed would then be would be $8,547.

Then less Franking Credits (0), less Other Tax Credits ($1,000) and less Estimated PAYG Tax on Wages ($2,000), would total $5,547 for the 2024 Estimated PAYG Instalments.

Find out more about how to produce a TaxFlow Report in TaxPlan showing the next 18 months of a client’s tax payments for all of their entities and individuals within their client group.