Use the power of using TaxPlan to advise your Primary Producer clients

Step by Step Instructions:

- Start a new TaxPlan client file and first create a Base Scenario without any strategies based on the client's usual Primary Production income and standard deductions. Learn more about adding scenarios.

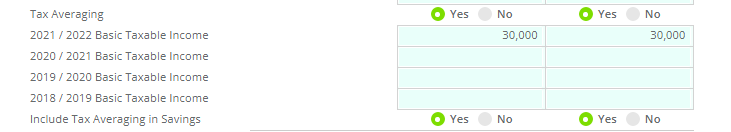

- Then, add new Scenarios and toggle the Tax Averaging setting on to expand the FY income fields, also select Yes or No to include tax averaging in the Tax Savings total.

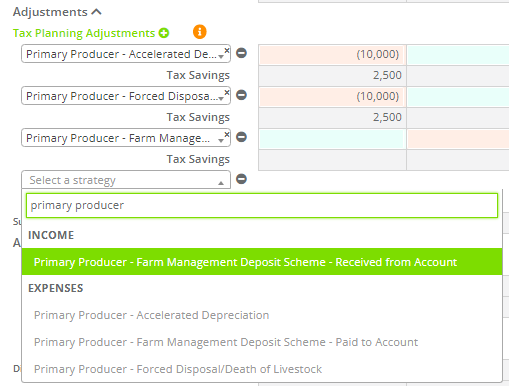

- Select to include the relevant Primary Producer specific strategies from the Tax Planning Adjustments available. The tax savings will automatically be calculated for each strategy.

- When all scenarios and strategies are completed select the recommended scenario.

- For a quick overview to assess the scenario outcomes initialy select Reports > Scenario Comparison as this will highlight the tax savings for your client for a quick discussion.

- When finalised, use the Next button to proceed to the next steps and produce a detailed Tax Planning Client Advice Report.

Pro Tip: Learn more about how Primary Producer Tax Averaging works for clients with one or more Nil or Loss PP income years